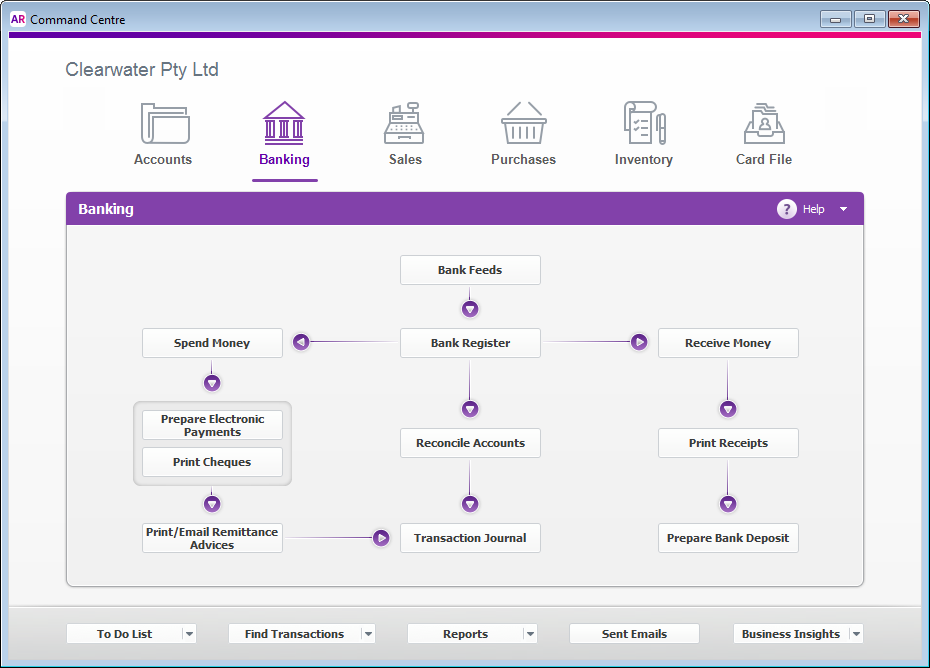

It offers many of the same features as QuickBooks and places a high value on mobility and accessibility – meaning you can download the Xero app for both iOS and Android. Xero is another popular accounting option for many businesses. Price: Small business plans begin at $24 per month. Everything is intuitive, which means nobody on your team will be wondering about where and how to get the information they need.Īdditionally, with solutions like a mobile app and QuickBooks online, you can have access to your important accounting information wherever you are – and not just on your desktop. The tool is comprehensive, but not bloated, cluttered, or difficult to navigate. But, arguably one of the best things this software has going for it is its level of user-friendliness.

Yes, QuickBooks is chock-full of features that you’ll find useful.

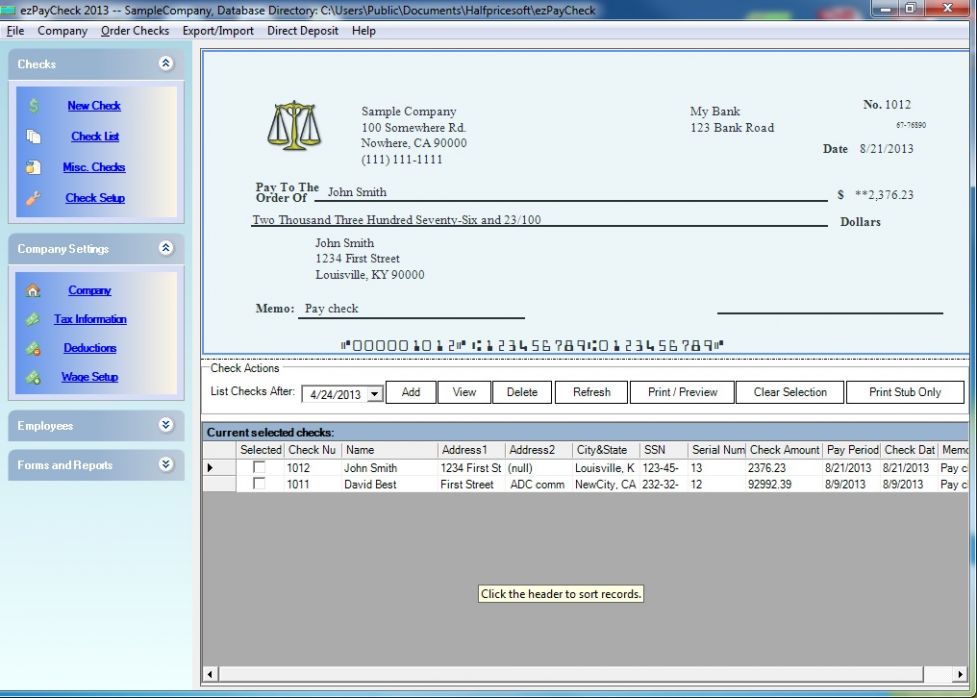

The software does everything you’d expect it to do – from tracking income and expenses to running payroll to generating helpful reports so that you can get a better grasp on how the company is performing financially. QuickBooks has different plans ranging from self-employed to small business or enterprise, which is the end of the spectrum you’ll want to aim for when you aren’t an independent contractor. And for good reason – QuickBooks has so many features and tools that will help you stay on top of your accounting and invoicing. When you think of the term “accounting software,” QuickBooks is likely one of the first to pop into your mind. With so many options out there, how can you zone in on the accounting software or solution that’s the best fit for your small or medium-sized business? We’ve rounded up five solid choices for you right here so that you can weigh your options and settle on the best tool for you. And, the better handle you have on the numbers, ultimately the more successful you’ll be. Whatever camp you fall into, this rule holds true: Solid accounting software will go a long way in keeping things streamlined and organized within your company. Or, perhaps you’re far more in touch with the finances – such as being an owner of the business or someone who works in the accounting department. Maybe your only involvement is something as limited as filing your own expense report or submitting invoices from contractors or vendors that you work with. And, when you work as part of a small to medium-sized business, you’re sure to have some interaction with those numbers – whether you’re the one actually responsible for keeping an eye on the money or not. Love them or hate them, they’re a core pillar of any successful company.

0 kommentar(er)

0 kommentar(er)